ethereum architecture pdf A Comprehensive Guide

Kicking off with ethereum architecture pdf, this exploration delves into the intricate design of Ethereum, highlighting its core components and functionalities. The architecture is not just a technical framework but the backbone that supports a myriad of applications and innovations in the blockchain space.

From the fundamental structure of the Ethereum Virtual Machine (EVM) to the security features that safeguard its ecosystem, understanding Ethereum’s architecture is essential for grasping the future of decentralized applications and smart contracts.

Overview of Ethereum Architecture

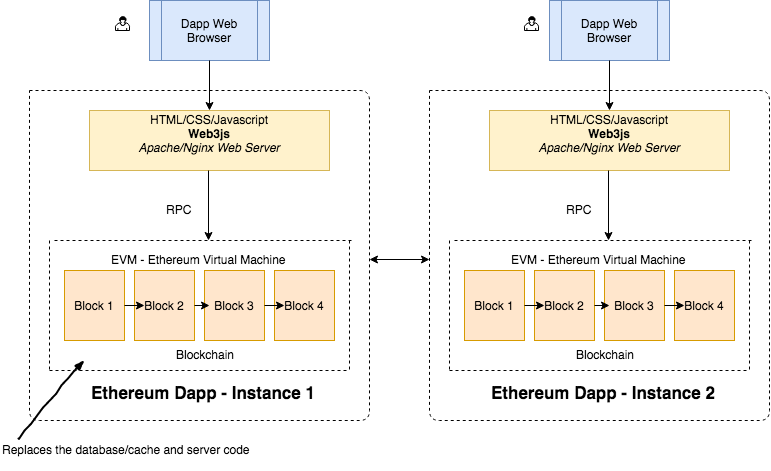

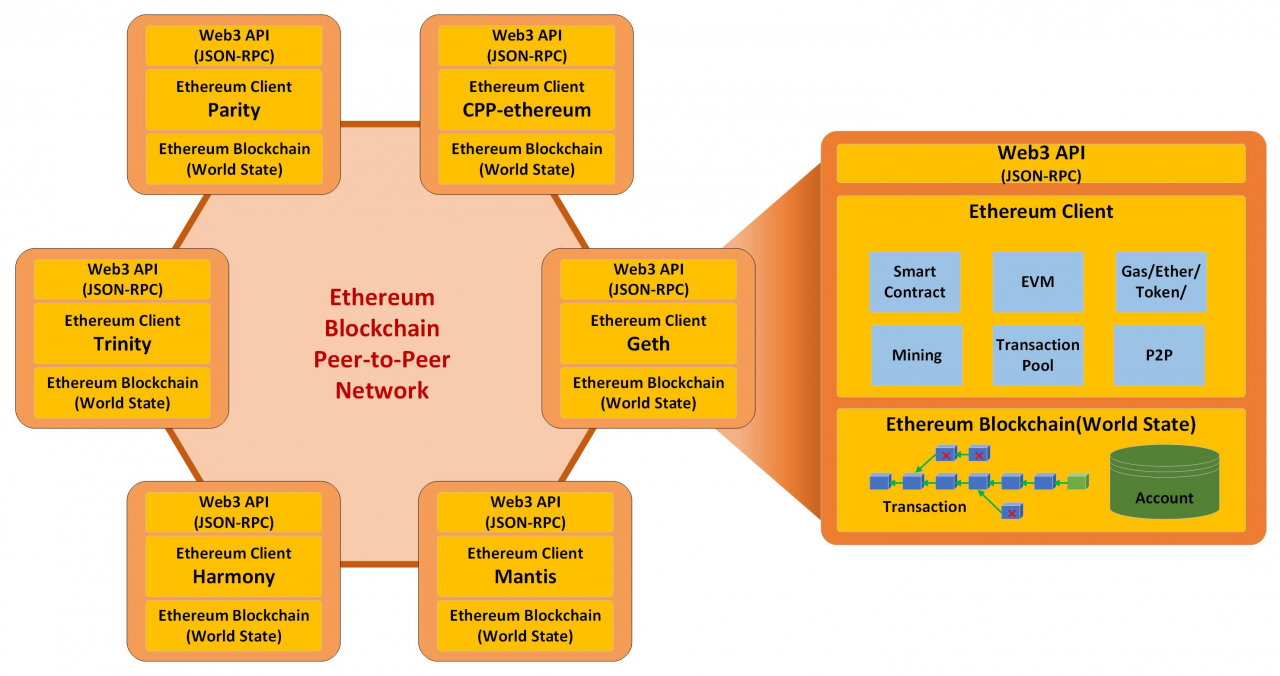

Ethereum is a decentralized platform that enables developers to build and deploy smart contracts and decentralized applications (dApps). Its architecture is built on several fundamental components, which work together to provide a robust framework for blockchain technology. This architecture encompasses the Ethereum Virtual Machine (EVM), smart contracts, and the underlying blockchain structure, all of which contribute to the functionality and security of the Ethereum network.

Fundamental Components of Ethereum Architecture

The architecture of Ethereum consists of multiple layers and components, including:

- Ethereum Virtual Machine (EVM): The runtime environment for executing smart contracts.

- Smart Contracts: Self-executing contracts with the terms of the agreement directly written into code.

- Nodes: Computers that participate in the Ethereum network, maintaining a copy of the blockchain.

- Blockchain: A distributed ledger that records all transactions and contract executions.

These components work together to create a decentralized ecosystem that allows for transparent and secure transactions.

Ethereum Virtual Machine (EVM)

The EVM is a crucial part of the Ethereum architecture. It acts as a decentralized computer that enables the execution of smart contracts across the network. It abstracts the complexity of the underlying blockchain, allowing developers to focus on writing code without worrying about the different configurations of nodes. The EVM operates on a stack-based architecture, where code is compiled into bytecode and executed in a sandboxed environment, ensuring that the smart contracts run exactly as intended.

Significance of Smart Contracts

Smart contracts are at the heart of Ethereum’s functionality, allowing for automated, trustless transactions and agreements. These contracts are immutable and transparent, meaning that once deployed, they cannot be altered, and their execution can be verified by anyone. This feature significantly reduces the risk of fraud and increases efficiency, making Ethereum a popular choice for various applications, from finance to supply chain management.

Blockchain Structure in Ethereum

The structure of Ethereum blocks is fundamental to its operation, with each block containing a list of transactions, a reference to the previous block, and a unique cryptographic hash. The importance of this structure lies in its ability to maintain the integrity and security of the blockchain.

Structure of Ethereum Blocks

Each block in the Ethereum blockchain has a specific structure that includes:

- Block Header: Contains metadata about the block, such as the timestamp, nonce, and the hash of the previous block.

- Transaction List: A list of transactions that have been validated and included in the block.

- State Root: A hash representing the state of the entire Ethereum network after the block’s transactions have been executed.

This block structure ensures that all transactions are securely recorded and can be traced back to their origins.

Role of Transaction Pools

Transaction pools, also known as mempools, play a crucial role in Ethereum’s architecture. They temporarily hold transactions that have been broadcasted to the network but have not yet been included in a block. Miners select transactions from this pool based on the transaction fees offered, incentivizing users to set higher fees for faster confirmations.

Comparison with Other Cryptocurrencies

When compared to other cryptocurrencies, Ethereum’s blockchain structure stands out due to its support for smart contracts. Unlike Bitcoin, which primarily serves as a digital currency, Ethereum’s architecture is designed for programmability, allowing for more complex transactions and the development of dApps. This flexibility has led to the rise of various projects and innovations within the Ethereum ecosystem.

Consensus Mechanisms in Ethereum

Consensus mechanisms are essential for maintaining the integrity and security of the blockchain. Ethereum originally utilized the Proof of Work (PoW) mechanism, which is being transitioned to Proof of Stake (PoS) as part of the Ethereum 2.0 upgrade.

Proof of Work (PoW) Mechanism

Under the PoW mechanism, miners compete to solve complex mathematical puzzles to validate transactions and create new blocks. This process consumes significant computational resources and energy, leading to concerns about sustainability and scalability. PoW has been instrumental in securing the Ethereum network since its inception, but as the platform evolves, so too does its approach to consensus.

Transition to Proof of Stake (PoS)

The transition to PoS represents a significant architectural shift for Ethereum. In this model, validators are chosen to create new blocks based on the number of coins they hold and are willing to ‘stake’ as collateral. This method is designed to enhance energy efficiency and scalability, allowing the network to process transactions more rapidly without the extensive computational overhead of PoW.

Advantages and Disadvantages of Consensus Mechanisms

Each consensus mechanism comes with its own set of advantages and disadvantages. Some key points include:

- Proof of Work:

- Advantages: High security and decentralization.

- Disadvantages: High energy consumption and slower transaction speeds.

- Proof of Stake:

- Advantages: Energy efficient and quicker transaction times.

- Disadvantages: Potential for centralization and reduced security if not implemented correctly.

This analysis highlights the ongoing evolution of Ethereum’s consensus mechanisms as it seeks to balance security, efficiency, and scalability.

Decentralized Applications (dApps) on Ethereum

Decentralized applications (dApps) are a significant aspect of Ethereum’s architecture, allowing developers to create applications that run on the blockchain. These applications leverage smart contracts to automate processes, eliminate intermediaries, and enhance transparency.

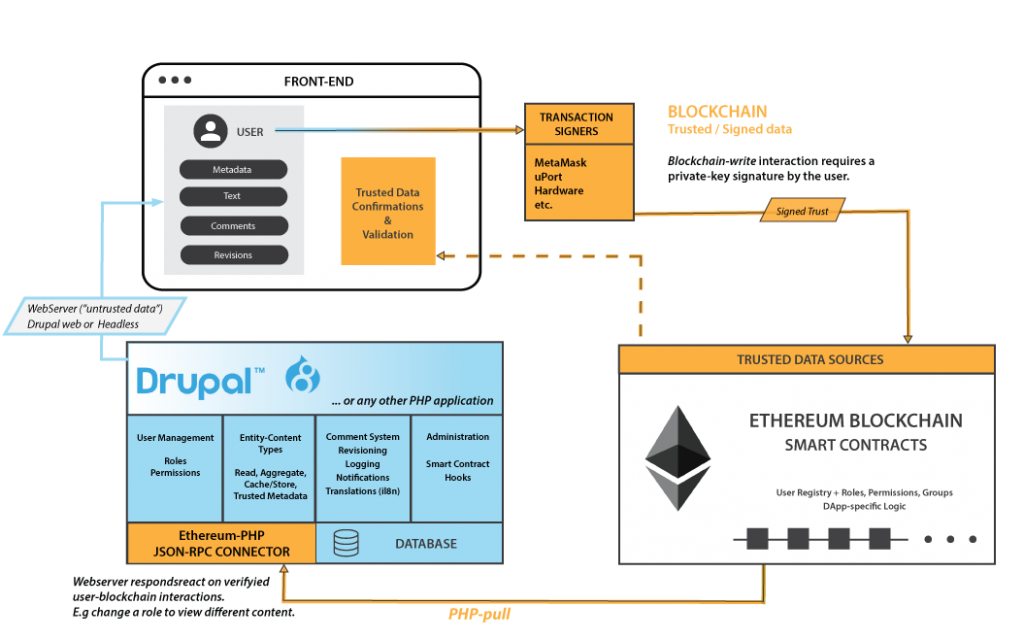

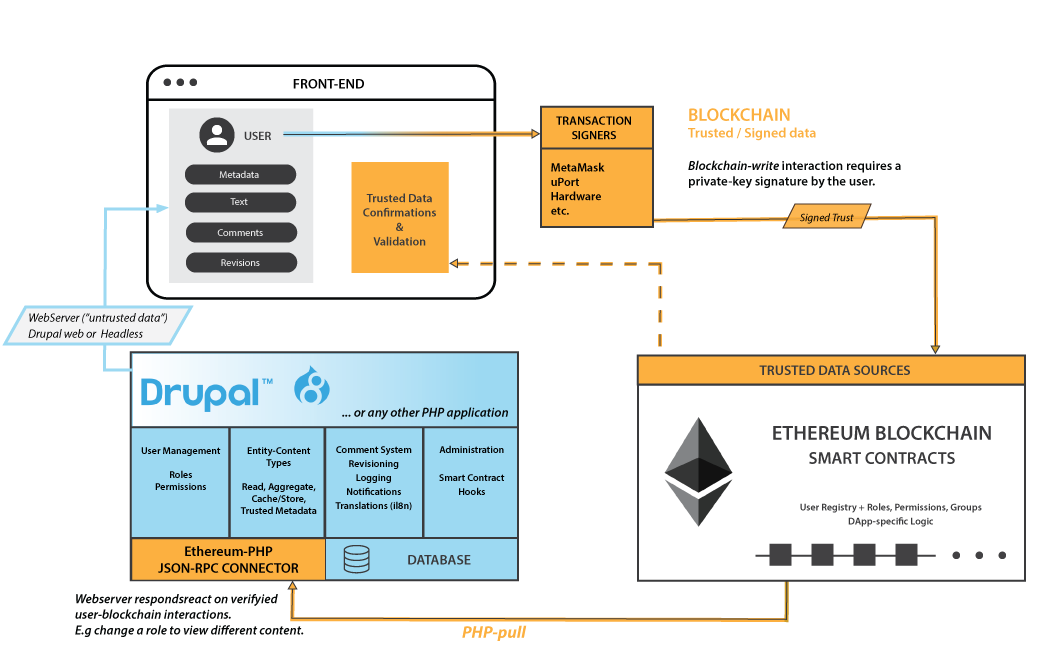

Architecture of Decentralized Applications

The architecture of dApps typically includes the following components:

- User Interface: The frontend through which users interact with the dApp.

- Smart Contracts: Backend logic that handles the application’s functionality.

- Blockchain: The underlying infrastructure that records all transactions.

This architecture enables dApps to operate independently of a central authority, providing users with a secure and transparent experience.

Examples of Popular dApps

Some well-known dApps that have gained traction include:

- Uniswap: A decentralized exchange that allows users to trade cryptocurrencies without intermediaries.

- Compound: A lending platform where users can earn interest on their crypto holdings.

- CryptoKitties: A blockchain-based game that allows users to buy, sell, and breed virtual cats.

These dApps demonstrate the versatility of the Ethereum platform and its ability to support various use cases.

Challenges in Developing dApps

Developing dApps within the Ethereum framework comes with its own set of challenges. These challenges include:

- Scalability: As user demand increases, the network can become congested, leading to slower transaction times.

- Security Vulnerabilities: Smart contracts can contain bugs that may be exploited if not properly audited.

- User Adoption: Convincing users to switch from traditional applications to dApps can be difficult.

Addressing these challenges is crucial for the continued growth and success of dApps on the Ethereum network.

Security Features in Ethereum Architecture

Security is paramount in the design and implementation of Ethereum’s architecture. The platform incorporates various security protocols to protect against vulnerabilities and attacks.

Security Protocols Implemented in Ethereum

Ethereum implements a range of security measures, including:

- Cryptographic Hash Functions: Used to secure data and validate transactions.

- Smart Contract Audits: Regular reviews to identify and mitigate potential vulnerabilities.

- Consensus Mechanisms: Designed to prevent double-spending and ensure network integrity.

These protocols work together to create a secure environment for users and developers alike.

Common Vulnerabilities in Ethereum Architecture

Despite its robust security features, Ethereum is not without vulnerabilities. Some common issues include:

- Reentrancy Attacks: Exploiting the ability of a smart contract to call itself recursively, potentially leading to loss of funds.

- Integer Overflow and Underflow: Errors in mathematical calculations that can lead to unintended consequences.

- Unverified Contracts: Deploying contracts without proper audits can introduce significant risks.

Addressing these vulnerabilities is essential for maintaining user trust and the overall integrity of the Ethereum network.

Comparative Analysis of Security Measures

When comparing security measures in Ethereum to those of other blockchain platforms, several key differences emerge. For instance, while Bitcoin focuses on securing transactions through a robust proof-of-work mechanism, Ethereum places a greater emphasis on the security of smart contracts and decentralized applications. The flexibility of Ethereum’s architecture allows for more complex security measures tailored to the needs of dApps.

Future Developments in Ethereum Architecture

As Ethereum continues to evolve, several anticipated upgrades and improvements to its architecture are on the horizon. These developments aim to enhance scalability, security, and usability within the network.

Anticipated Upgrades and Improvements

Future upgrades for Ethereum include:

- Ethereum 2.0: Transitioning to Proof of Stake and sharding to improve scalability.

- Layer 2 Solutions: Implementing sidechains and state channels to offload transactions from the main chain.

- Enhanced Interoperability: Improving compatibility with other blockchains and systems.

These upgrades are crucial for keeping Ethereum competitive in the rapidly evolving blockchain landscape.

Impact of Ethereum 2.0 on Architecture

Ethereum 2.0 is poised to have a transformative effect on the network’s architecture. The move to PoS is expected to reduce energy consumption significantly while increasing transaction throughput. Additionally, sharding allows for parallel processing of transactions, further enhancing scalability and performance.

Emerging Trends in Blockchain Technology

As blockchain technology advances, several trends may influence Ethereum’s future architecture, including:

- Increased Focus on Privacy: Solutions such as zero-knowledge proofs may become more common.

- Decentralized Finance (DeFi): The rise of DeFi applications may drive new architectural considerations.

- Cross-Chain Interoperability: The need for seamless interaction between different blockchain networks.

These trends highlight the dynamic nature of blockchain technology and its implications for the evolution of Ethereum.

Use Cases of Ethereum Architecture

The versatility of Ethereum’s architecture allows for a wide range of real-world applications across various industries. These use cases demonstrate the potential impact of Ethereum on businesses and society.

Real-World Applications of Ethereum

Ethereum’s architecture has been utilized in numerous industries, including:

- Finance: DeFi applications that facilitate lending, borrowing, and trading without intermediaries.

- Supply Chain Management: Tracking goods and verifying their authenticity through smart contracts.

- Healthcare: Securely sharing patient data while maintaining privacy and consent.

These applications illustrate the practical benefits of adopting Ethereum’s architecture in various fields.

Case Studies Showcasing Ethereum’s Impact

A table summarizing case studies showcasing Ethereum’s impact across different industries can be organized as follows:

| Industry | Project | Description |

|---|---|---|

| Finance | Aave | A decentralized lending platform that allows users to lend and borrow cryptocurrencies. |

| Art | Foundation | A marketplace for digital art that leverages NFTs (Non-Fungible Tokens). |

| Gaming | Axie Infinity | A blockchain-based game that enables users to earn cryptocurrencies through gameplay. |

Innovative Projects Utilizing Ethereum Architecture

Numerous innovative projects are leveraging Ethereum’s architecture, contributing to its societal benefits. For example, projects focusing on renewable energy trading, identity verification, and decentralized governance are gaining prominence. These projects harness the unique features of Ethereum to create solutions that address pressing global challenges.

Comparative Analysis of Ethereum and Other Blockchain Architectures

Understanding the differences between Ethereum and other blockchain architectures is crucial for recognizing its unique value proposition.

Comparison with Bitcoin’s Architecture

Ethereum’s architecture differs significantly from Bitcoin’s, particularly in its support for smart contracts. While Bitcoin primarily functions as a digital currency, Ethereum serves as a platform for decentralized applications. Key differences include:

- Flexibility: Ethereum allows for programmable smart contracts, while Bitcoin is limited to simple transactions.

- Transaction Speed: Ethereum can process transactions more quickly than Bitcoin due to its design.

These distinctions highlight Ethereum’s versatility and broader applicability.

Architecture of Competing Smart Contract Platforms

Several competing smart contract platforms, such as Cardano and Polkadot, have emerged, each offering unique features. For instance, Cardano emphasizes a research-driven approach to development, while Polkadot focuses on interoperability between different blockchains. These platforms challenge Ethereum’s dominance by addressing specific limitations within its architecture.

Summary of Strengths and Weaknesses

A table summarizing the strengths and weaknesses of different blockchain architectures can help clarify their unique attributes:

| Platform | Strengths | Weaknesses |

|---|---|---|

| Ethereum | Smart contracts, flexibility, large developer community. | Scalability issues, high gas fees. |

| Bitcoin | Robust security, established network effect. | Limited programmability, slower transaction speeds. |

| Cardano | Research-driven, energy-efficient. | Less adoption, slower development. |

This comparative analysis provides insights into the relative strengths and weaknesses of various blockchain architectures and their implications for future developments.

Summary

In conclusion, the ethereum architecture pdf encapsulates the vast potential and complexity of Ethereum’s framework. As it continues to evolve with upgrades like Ethereum 2.0, the implications of its architecture will shape the future of decentralized technologies and innovative projects across various industries.

Detailed FAQs

What is the Ethereum Virtual Machine (EVM)?

The EVM is a decentralized computing environment that executes smart contracts and allows decentralized applications to run on the Ethereum blockchain.

How does Ethereum’s blockchain differ from Bitcoin’s?

Ethereum’s blockchain supports programmable smart contracts, while Bitcoin’s primarily facilitates peer-to-peer transactions.

What is a decentralized application (dApp)?

A dApp is an application that runs on a blockchain network, utilizing smart contracts to function without a central authority.

What are the security features of Ethereum?

Ethereum incorporates various security protocols, including cryptographic techniques and consensus mechanisms, to protect its network and transactions.

What are the advantages of the Proof of Stake (PoS) mechanism?

PoS offers higher energy efficiency and scalability compared to Proof of Work (PoW), enabling a more sustainable and faster network.