Bitwise Bitcoin Ethereum Etf Sec Approval Insights

Bitwise Bitcoin Ethereum ETF SEC approval is generating significant buzz in the investment community as regulators evaluate the viability of cryptocurrency ETFs. This discussion not only sheds light on the innovative approaches taken by Bitwise but also explores the broader implications for investors navigating the exciting yet volatile landscape of digital assets.

With the growing interest in Bitcoin and Ethereum, understanding how ETFs can provide exposure to these cryptocurrencies is essential. Bitwise has emerged as a key player, aiming to redefine investment opportunities while adhering to regulatory standards set by the SEC.

Introduction to Bitwise Bitcoin ETF

The rise of cryptocurrencies has ushered in a new era for investors, and one of the most significant developments in this space is the introduction of Exchange-Traded Funds (ETFs). An ETF is a type of investment fund that is traded on stock exchanges, much like stocks. It holds assets such as stocks, commodities, or cryptocurrencies and derives its value from the underlying assets.

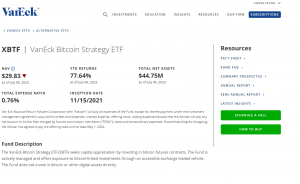

Bitwise Asset Management has been at the forefront of creating Bitcoin ETFs, which aim to provide investors with a regulated and simplified way to invest in Bitcoin without having to navigate complex wallets or exchanges.Bitwise’s approach to Bitcoin ETFs is particularly notable. They focus on transparency, security, and liquidity, which are crucial factors that can help mitigate the risks associated with investing in cryptocurrencies.

By offering a Bitcoin ETF, Bitwise aims to bridge the gap between traditional finance and the burgeoning cryptocurrency market, making it easier for institutional and individual investors to gain exposure to Bitcoin's price movements. The potential benefits of investing in Bitcoin via an ETF include easier access, increased liquidity, and the ability to hold Bitcoin in tax-advantaged accounts like IRAs.

Understanding Ethereum and Its ETF Potential

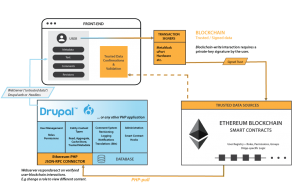

Ethereum, often seen as the second-largest cryptocurrency by market capitalization, is fundamentally different from Bitcoin. While Bitcoin is primarily a digital currency, Ethereum serves as a decentralized platform that enables developers to build smart contracts and decentralized applications (dApps). This distinction makes Ethereum not just a currency but a versatile technology that can unleash a myriad of use cases in various industries.The implications of an Ethereum ETF could be profound.

An ETF would allow investors to gain exposure to Ethereum without dealing with the complexities of cryptocurrency wallets and exchanges. Furthermore, it could attract institutional interest, resulting in increased liquidity and potentially driving the price higher. Bitwise has recognized the burgeoning potential of an Ethereum ETF and has expressed intentions to explore the development of such a product, which could mark a significant milestone in the maturation of the cryptocurrency market.

The Role of SEC in Cryptocurrency ETFs

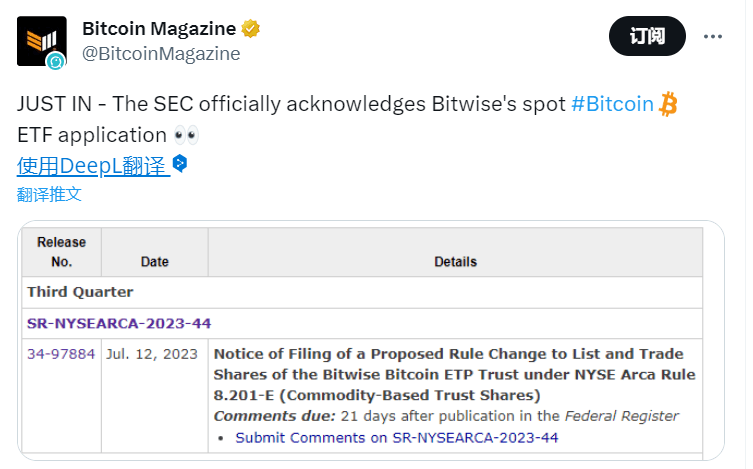

The Securities and Exchange Commission (SEC) plays a pivotal role in regulating ETFs in the United States. The regulatory framework established by the SEC is designed to protect investors while ensuring fair and efficient markets. When it comes to cryptocurrency ETFs, the SEC has been cautious, citing concerns over market manipulation, liquidity, and the overall robustness of the underlying assets.The SEC’s position on cryptocurrency ETFs has evolved, with several applications being rejected in the past due to various concerns.

Key factors that the SEC considers when evaluating ETF applications include the market's size and liquidity, the potential for fraud or market manipulation, and the adequacy of investor protection mechanisms. As the landscape continues to change, the SEC's stance may also adapt to accommodate the growing interest in cryptocurrency investment vehicles.

Recent Developments in ETF Approvals

In recent months, there have been notable developments regarding ETF approvals by the SEC. The timeline of these approvals and rejections has created significant market speculation, particularly regarding Bitcoin and Ethereum ETFs. While Bitcoin ETFs have seen some approvals, Ethereum ETFs have faced more scrutiny, leading to varying outcomes for both.The implications of these decisions are substantial for investors and the broader market.

Approval of a Bitcoin ETF could lead to increased institutional investment, while delays or rejections of Ethereum ETFs could hinder market growth and investor confidence. Understanding these dynamics is crucial for anyone looking to navigate the cryptocurrency investment landscape.

Market Reactions to Potential ETF Approvals

Market sentiment can shift dramatically in response to news regarding ETF approvals. Historically, announcements related to ETF applications have often led to significant price movements for both Bitcoin and Ethereum. For instance, when a Bitcoin ETF was filed, there was an observable surge in its price, reflecting heightened optimism among investors.Investor behavior tends to vary before and after significant ETF news.

Prior to announcements, many traders may speculate and accumulate positions, hoping to capitalize on potential price increases. After the news is released, the market often reacts sharply, leading to volatility. This behavior highlights the importance of keeping abreast of ETF developments as they can significantly influence market dynamics.

Future Prospects of Bitwise Bitcoin and Ethereum ETFs

Looking ahead, the future of Bitwise Bitcoin and Ethereum ETFs appears promising, particularly given the increasing interest in cryptocurrency investment. Current trends indicate a growing acceptance of digital assets within traditional financial frameworks, and this could pave the way for more favorable conditions for ETF approvals. Technological advancements, such as improved blockchain infrastructure and enhanced security measures, could further influence the ETF approval processes.

However, Bitwise may face challenges, including regulatory hurdles and competition from other firms aiming to launch similar products. Navigating these challenges will be crucial for Bitwise’s success in establishing Bitcoin and Ethereum ETFs.

Investment Strategies Involving Bitcoin and Ethereum ETFs

Integrating Bitcoin and Ethereum ETFs into an investment portfolio can be a strategic decision for both new and seasoned investors. A well-rounded investment strategy should consider the unique characteristics of cryptocurrencies, including their volatility and growth potential. Risk management techniques are essential when considering cryptocurrency ETFs. Investors should maintain a diversified portfolio, set clear investment goals, and be prepared for market fluctuations.

To facilitate understanding, here’s a comparison of traditional investment strategies versus ETF strategies for cryptocurrencies:

| Traditional Investment Strategies | ETF Strategies for Cryptocurrencies |

|---|---|

| Direct asset purchase | Indirect exposure through traded funds |

| Higher management fees | Lower fees due to passive management |

| Full responsibility for asset security | Managed security by the ETF provider |

| Potentially lower liquidity | Higher liquidity through stock exchange trading |

Closure

In conclusion, the potential approval of Bitwise Bitcoin and Ethereum ETFs could reshape the future of cryptocurrency investments. As market dynamics continue to evolve, the implications of SEC decisions will be crucial for both investors and the overall cryptocurrency ecosystem. Keeping an eye on these developments will be vital for anyone interested in capitalizing on the opportunities presented by digital currencies.

Questions Often Asked

What is an ETF?

An ETF, or Exchange-Traded Fund, is an investment fund that trades on stock exchanges, similar to stocks, and can provide investors exposure to various assets including cryptocurrencies.

How does Bitwise approach Bitcoin ETFs?

Bitwise focuses on creating innovative Bitcoin ETFs that comply with regulatory standards while aiming to educate investors on the benefits of cryptocurrency investment.

What is the SEC's role in ETF approvals?

The SEC, or Securities and Exchange Commission, regulates and evaluates ETF applications to ensure they meet legal and market stability requirements.

What are the risks of investing in cryptocurrency ETFs?

Investing in cryptocurrency ETFs carries risks such as market volatility, regulatory changes, and the inherent unpredictability of digital assets.

How can investors benefit from Bitcoin and Ethereum ETFs?

Investors can gain diversified exposure to cryptocurrencies, potentially benefit from professional management, and enjoy the convenience of trading ETFs on traditional exchanges.