Will Bitcoin and Ethereum Rise Again Exploring Trends

Will bitcoin and ethereum rise again? This question sparks a riveting conversation about the future of these leading cryptocurrencies and the myriad of factors influencing their market performance. As we delve into current trends, economic indicators, and historical data, it becomes clear that understanding the dynamics at play is essential for anyone looking to navigate the crypto landscape.

In recent months, both Bitcoin and Ethereum have experienced significant fluctuations, prompting investors and enthusiasts alike to seek clarity on what lies ahead. By analyzing expert predictions, community sentiment, and the impact of global economic events, we can gain valuable insights into whether these digital assets are poised for another surge or facing headwinds in the market.

Current Trends in Cryptocurrency

The cryptocurrency market is experiencing notable fluctuations, particularly with Bitcoin and Ethereum, which continue to capture the attention of investors and analysts alike. Recent trends indicate a volatile environment influenced by various economic and technological factors. Understanding these trends is integral for anyone looking to navigate the current landscape effectively.Several factors are currently influencing the prices of Bitcoin and Ethereum.

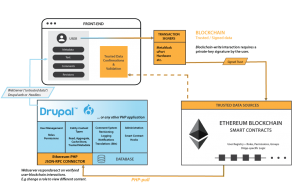

Economic indicators such as inflation rates, interest rates, and stock market performance play crucial roles. Additionally, the ongoing developments in blockchain technology and increasing adoption among retail and institutional investors serve as significant catalysts for price movements. Historical performance also offers insight; both Bitcoin and Ethereum have shown patterns that correspond with market trends, such as increased activity during economic downturns.

Influencing Factors for Price Changes

The prices of Bitcoin and Ethereum are subject to a myriad of economic indicators and regulatory changes, making them highly sensitive to market dynamics. Here are key elements influencing their price trajectories:

- Economic Indicators: Factors like inflation rates and employment statistics can sway investor sentiment and affect cryptocurrency prices.

- Regulatory Changes: Government regulations around the world, from positive endorsements to stringent restrictions, directly impact market confidence and accessibility.

- Technological Advancements: Innovations in blockchain technology can enhance the functionality and appeal of cryptocurrencies, thereby influencing their market valuation.

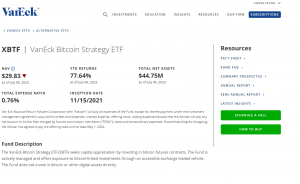

Market Predictions and Forecasts

Expert predictions about Bitcoin and Ethereum serve as a compass for investors looking to make informed decisions. Below is a comparison table of various expert forecasts:

| Expert | Bitcoin Prediction | Ethereum Prediction |

|---|---|---|

| Analyst A | $50,000 by Q4 2023 | $4,000 by Q4 2023 |

| Analyst B | $45,000 by Q1 2024 | $3,800 by Q1 2024 |

| Analyst C | $55,000 by mid-2024 | $4,500 by mid-2024 |

A wealth of resources is available for those seeking market forecasts. Analysts often utilize technical analysis, fundamental analysis, and sentiment analysis to predict cryptocurrency trends. These methodologies help in understanding market psychology and potential price movements.

Historical Performance Analysis

Examining the historical performance of Bitcoin and Ethereum reveals patterns that could shape future trends. A timeline of significant price changes highlights key events that influenced their valuation:

- 2017: Bitcoin reaches an all-time high of nearly $20,000, driven by speculative trading and media hype.

- 2020: The COVID-19 pandemic leads to increased adoption of digital currencies as a hedge against inflation.

- 2021: Ethereum's price surges due to the growth of DeFi and NFTs, marking a significant milestone in its historical performance.

Recognizing patterns such as these plays a vital role in forecasting price movements. Historical data remains an essential tool for investors, providing context and insight into potential future behavior based on past trends.

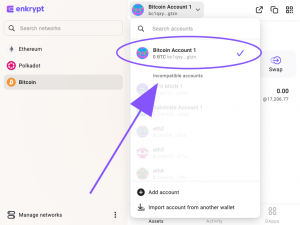

Investment Strategies for Bitcoin and Ethereum

For individuals looking to capitalize on potential price rises, well-defined investment strategies are essential. Key approaches include:

- Dollar-Cost Averaging: Investing a fixed amount regularly, regardless of price fluctuations, to mitigate volatility risks.

- Long-term Holding: Maintaining investments over an extended period to benefit from overall growth trends.

- Active Trading: Engaging in short-term trading to take advantage of market volatility for profit generation.

Risk management techniques are crucial for navigating the inherent volatility of cryptocurrencies. Investors should consider factors such as portfolio diversification, setting stop-loss orders, and staying informed about market developments.

Community Sentiment and Its Impact

Community sentiment on social media significantly influences market dynamics for Bitcoin and Ethereum. Platforms like Twitter and Reddit serve as hubs for discussions, with posts often swaying public perception and investment decisions. Major influencers and figures in the cryptocurrency space can amplify this sentiment, whether positively or negatively.Sentiment analysis tools have emerged to monitor discussions and gauge market sentiment more accurately.

These tools analyze social media trends, news coverage, and public opinion, providing insights that can affect investment strategies.

Global Economic Impact on Cryptocurrency

Global economic events wield considerable influence on Bitcoin and Ethereum, creating a complex interplay between traditional markets and the cryptocurrency space. Economic downturns or crises often lead to increased interest in cryptocurrencies as alternative investments.The relationship between inflation rates and cryptocurrency investments is particularly noteworthy. High inflation can erode purchasing power, prompting investors to seek refuge in digital assets. Furthermore, international trade policies can directly impact cryptocurrency values, as regulations or tariffs can alter market accessibility and investor sentiment.

Wrap-Up

In conclusion, the future of Bitcoin and Ethereum remains a combination of opportunity and uncertainty. By keeping abreast of market trends, expert analyses, and community sentiments, investors can better position themselves to take advantage of potential rises. As we continue to monitor these cryptocurrencies, one thing is certain: the journey of Bitcoin and Ethereum is far from over, and the next chapter is waiting to be written.

FAQ Corner

What are the key factors affecting Bitcoin and Ethereum prices?

The prices are influenced by market trends, regulatory changes, economic indicators, and technological advancements.

How can historical performance inform future predictions?

Analyzing past price movements can identify patterns that may indicate future trends in the cryptocurrency market.

Are there specific strategies for investing in these cryptocurrencies?

Yes, effective investment strategies involve thorough research, risk management, and staying updated on market developments.

How does community sentiment impact cryptocurrency values?

Community sentiment can significantly affect market perception, influencing buying and selling behaviors among investors.

What role do global economic events play in cryptocurrency valuations?

Global economic factors, such as inflation and trade policies, can impact investor confidence and, consequently, cryptocurrency values.