Best Ethereum And Bitcoin Etf Investment Insights

With best ethereum and bitcoin etf at the forefront, the world of cryptocurrency investment is evolving rapidly, captivating the interest of both seasoned investors and newcomers alike. As cryptocurrencies gain traction, Exchange-Traded Funds (ETFs) offer a structured and accessible way to invest in these digital assets without the complexities of direct ownership. This growing trend reflects a significant shift in how individuals are approaching the crypto market, creating new opportunities to profit while diversifying their portfolios.

Understanding Ethereum and Bitcoin ETFs is essential for anyone looking to navigate the crypto space effectively. These financial instruments not only simplify the investment process but also present various types tailored to different investment strategies, making it crucial to explore their benefits, risks, and the best options available.

Introduction to Ethereum and Bitcoin ETFs

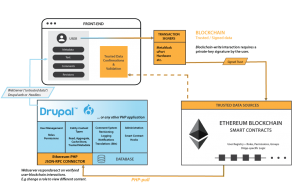

Ethereum and Bitcoin ETFs (Exchange-Traded Funds) are investment vehicles that allow investors to gain exposure to these two leading cryptocurrencies without the need to directly purchase or store the digital assets. The primary purpose of these ETFs is to provide a more accessible, regulated, and convenient way to invest in cryptocurrencies. The significance of ETFs in cryptocurrency investment lies in their ability to attract mainstream investors who may be hesitant to engage with the complexities of cryptocurrency exchanges and wallets.

In recent years, there has been a noticeable increase in interest among investors for Ethereum and Bitcoin ETFs, driven by the growing acceptance of cryptocurrencies and the potential for significant returns.

Types of Ethereum and Bitcoin ETFs

There are various types of ETFs focused on Ethereum and Bitcoin, each catering to different investment strategies and risk appetites. The most common types include:

- Physically-Backed ETFs: These funds hold actual Bitcoin or Ethereum as their underlying asset, offering investors direct exposure to the price movements of the cryptocurrencies.

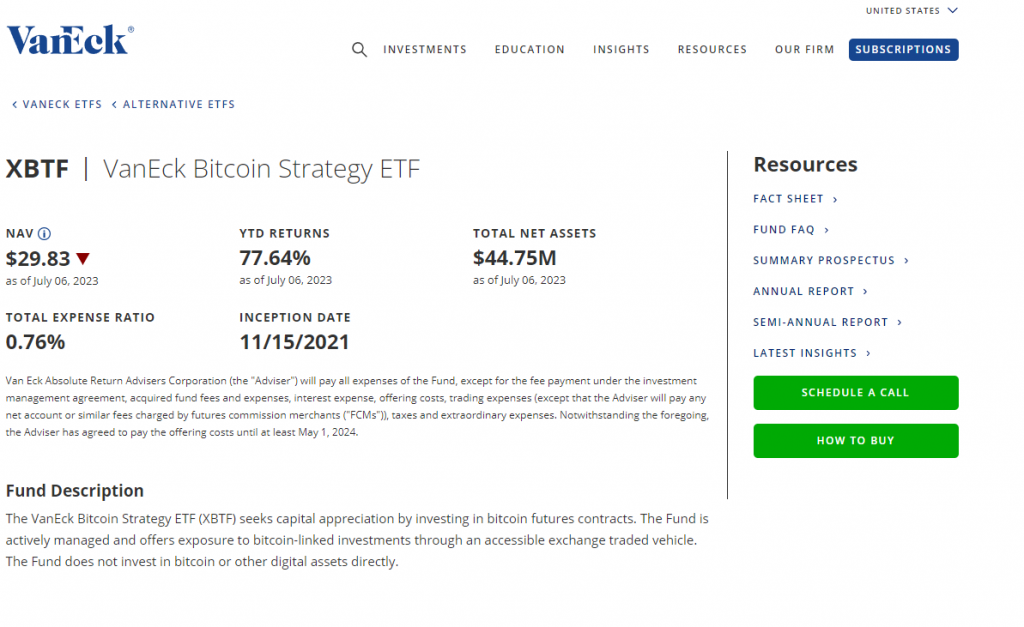

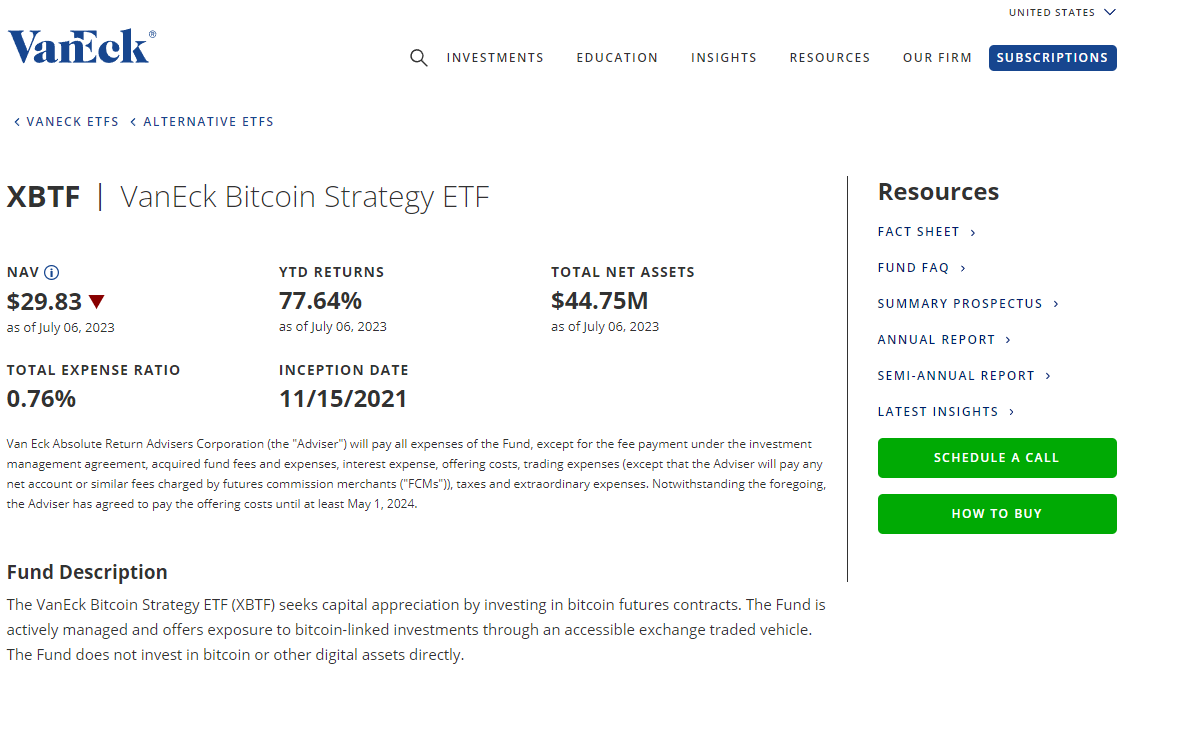

- Futures-Based ETFs: These ETFs invest in futures contracts rather than holding the actual cryptocurrencies, allowing investors to speculate on the future price of Bitcoin or Ethereum.

- Leveraged ETFs: These funds aim to deliver multiples of the performance of the underlying cryptocurrencies, appealing to traders looking for amplified returns.

Examples of popular Ethereum and Bitcoin ETFs in the market include the Grayscale Bitcoin Trust (GBTC), ProShares Bitcoin Strategy ETF (BITO), and the Grayscale Ethereum Trust (ETHE). These funds have garnered significant attention from investors looking to capitalize on the growth of the cryptocurrency market.

Benefits of Investing in Ethereum and Bitcoin ETFs

Investing in Ethereum and Bitcoin ETFs offers several advantages compared to purchasing cryptocurrencies directly. Key benefits include:

- Ease of Access: ETFs can be bought and sold like stocks on major exchanges, making them more accessible for traditional investors.

- Diversification: By investing in ETFs, investors can gain exposure to a basket of cryptocurrencies or related assets, reducing the risk associated with individual holdings.

- Regulatory Framework: ETFs operate within regulatory guidelines, providing a layer of security and transparency that direct cryptocurrency investments may lack.

The regulatory and security advantages provided by ETFs can help investors feel more comfortable in their investments, especially given the historical volatility and risks associated with cryptocurrencies.

Risks Associated with Ethereum and Bitcoin ETFs

Despite the advantages, investing in cryptocurrency ETFs also carries certain risks that investors should be aware of. Potential risks include:

- Market Volatility: The value of Ethereum and Bitcoin ETFs can be highly volatile, influenced by market trends, investor sentiment, and other external factors.

- Tracking Error: ETFs may not perfectly track the price of their underlying assets, leading to discrepancies in performance.

- Regulatory Risks: Changes in regulations concerning cryptocurrencies and ETFs can impact the availability and performance of these investment products.

Investors should conduct thorough research and consider these risks when evaluating their investment options.

How to Choose the Best Ethereum and Bitcoin ETFs

Evaluating the best Ethereum and Bitcoin ETFs for investment requires careful consideration of several criteria. Important factors include:

- Expense Ratios: Lower expense ratios can significantly impact long-term returns, so it’s crucial to compare fees across different ETFs.

- Fund Performance: Analyze historical performance data to gauge how well the ETF has tracked its underlying assets.

- Assets Under Management (AUM): A higher AUM can indicate investor confidence and stability within the ETF.

A comparison table of top Ethereum and Bitcoin ETFs based on key metrics can assist investors in making informed decisions.

Future Trends in Ethereum and Bitcoin ETFs

The ETF market for cryptocurrencies is poised for significant developments in the coming years. Potential future trends include:

- Increased Institutional Adoption: As more institutions look to diversify their portfolios, the demand for cryptocurrency ETFs is likely to rise.

- Innovative Products: New ETF products, such as those focusing on decentralized finance (DeFi) or non-fungible tokens (NFTs), may emerge, broadening investment opportunities.

- Regulatory Clarity: As regulations become clearer, more investors may feel comfortable entering the cryptocurrency space through ETFs.

These trends could positively influence the performance and acceptance of Ethereum and Bitcoin ETFs among a broader range of investors.

Strategies for Investing in Ethereum and Bitcoin ETFs

Developing effective investment strategies for Ethereum and Bitcoin ETFs is essential for maximizing returns. Key strategies include:

- Dollar-Cost Averaging: This strategy involves regularly investing a fixed amount of money, regardless of market conditions, to reduce the impact of volatility.

- Rebalancing Portfolios: Periodically adjusting the allocation of cryptocurrency ETFs within an investment portfolio can help maintain desired risk levels and optimize performance.

These strategies can guide investors in navigating the complexities of ETF investments while managing risk effectively.

Case Studies of Successful Ethereum and Bitcoin ETF Investments

Real-life examples of successful investments in Ethereum and Bitcoin ETFs can provide valuable insights for potential investors. Many individuals and institutions have reaped rewards from their strategic investments in these funds. Factors contributing to their success often include:

- Market Timing: Investing during periods of growth and favorable market conditions has proven beneficial for many investors.

- Long-Term Vision: Maintaining a long-term perspective has allowed investors to ride out market volatility and capitalize on overall growth.

Lessons learned from these case studies emphasize the importance of research, strategic planning, and disciplined investing for achieving success in the cryptocurrency ETF market.

Epilogue

In summary, the best ethereum and bitcoin etf options are transforming the landscape of cryptocurrency investment, offering both benefits and challenges that investors must navigate. As the market continues to evolve, staying informed about the latest trends and strategies will be key to maximizing potential returns. Whether you’re a novice or an experienced trader, understanding these ETFs could be your gateway to capitalizing on the dynamic world of digital currencies.

FAQ Resource

What are the main advantages of investing in ETFs?

ETFs offer diversification, lower fees, and regulatory protections compared to direct cryptocurrency purchases.

How do I know which ETF is right for me?

Evaluate ETFs based on criteria such as expense ratios, fund performance, and investment goals.

Are there tax implications when investing in cryptocurrency ETFs?

Yes, gains from ETF investments are subject to capital gains tax, similar to other investments.

Can I invest in Ethereum and Bitcoin ETFs through my retirement account?

Many brokerage firms allow investing in ETFs through retirement accounts like IRAs, but check specific account rules.

What is the difference between physically-backed and futures-based ETFs?

Physically-backed ETFs hold actual cryptocurrencies, while futures-based ETFs invest in contracts predicting future price movements.